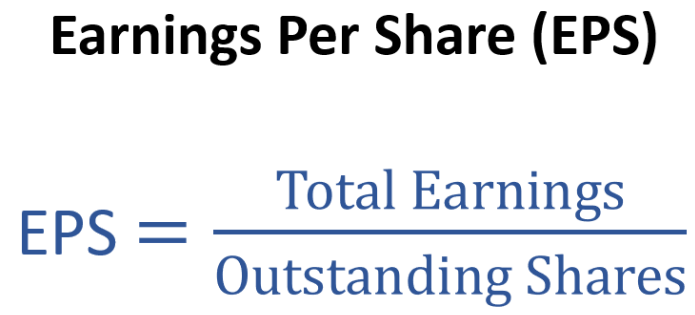

Earnings per share (EPS) is calculated as a company’s Net profit divided by the total number of shares of its common stock and the resulting number is an indicator of a company’s profitability. So, investors value the companies with greater Earnings Per Share and provide higher share prices to the respective companies. The result of Earnings per share is assigned a rating from 1 to 99, with 99 being best.

Net Profit of Commercial Banks in Nepal

| S.N | Names of Commercial Bank | Net Profit (in Arba) |

| 1 | Rastriya Banijya Bank | 4.45 |

| 2 | Nabil Bank | 3.57 |

| 3 | Agricultural Development Bank | 3.47 |

| 4 | NIC Asia Bank | 3.12 |

| 5 | Global IME Bank | 3.09 |

| 6 | Nepal Investment Bank | 2.57 |

| 7 | Nepal Bank | 2.56 |

| 8 | Himalayan Bank | 2.54 |

| 9 | Everest Bank | 2.5 |

| 10 | Prime Commercial Bank | 2.29 |

| 11 | NMB Bank | 2.27 |

| 12 | Siddhartha Bank | 2.09 |

| 13 | Standard Chartered Bank | 1.98 |

| 14 | Sanima Bank | 1.7 |

| 15 | Nepal SBI Bank | 1.53 |

| 16 | Mega Bank | 1.52 |

| 17 | Bank of Kathmandu | 1.48 |

| 18 | Laxmi Bank | 1.48 |

| 19 | Sunrise Bank | 1.39 |

| 20 | Prabhu Bank | 1.37 |

| 21 | Machhapuchchhre Bank | 1.25 |

| 22 | Nepal Bangladesh Bank | 1.24 |

| 23 | Kumari Bank | 1.22 |

| 24 | NCC Bank | 1.13 |

| 25 | Citizens Bank | 1.12 |

| 26 | Century Commercial Bank | 0.91 |

| 27 | Civil Bank | 0.46 |

Related: How to Open a Global IME bank account online

Number of Shares of Commercial Banks in Nepal (with their Paid-Up Capital)

| S.N | Commercial Bank | Paid Up Capital (Arba) | No. of Ordinary Shares ( crores) |

| 1 | Rastriya Banijya Bank | 9 | 9 |

| 2 | Nabil Bank | 10.1 | 10.1 |

| 3 | Agricultural Development Bank | 14.99 | 9.56 |

| 4 | NIC Asia Bank | 9.72 | 9.72 |

| 5 | Global IME Bank | 18.98 | 18.98 |

| 6 | Nepal Investment Bank | 14.25 | 14.25 |

| 7 | Nepal Bank | 11.28 | 11.28 |

| 8 | Himalayan Bank | 9.37 | 9.37 |

| 9 | Everest Bank | 8.51 | 8.51 |

| 10 | Prime Commercial Bank | 13.99 | 13.99 |

| 11 | NMB Bank | 13.95 | 13.95 |

| 12 | Siddhartha Bank | 9.79 | 9.79 |

| 13 | Standard Chartered Bank | 8.01 | 8.01 |

| 14 | Sanima Bank | 8.8 | 8.8 |

| 15 | Nepal SBI Bank | 8.96 | 8.96 |

| 16 | Mega Bank | 13.14 | 13.14 |

| 17 | Bank of Kathmandu | 8.55 | 8.55 |

| 18 | Laxmi Bank | 9.81 | 9.81 |

| 19 | Sunrise Bank | 8.97 | 8.97 |

| 20 | Prabhu Bank | 10.32 | 10.32 |

| 21 | Machhapuchchhre Bank | 8.46 | 8.46 |

| 22 | Nepal Bangladesh Bank | 8.5 | 8.5 |

| 23 | Kumari Bank | 12.52 | 12.52 |

| 24 | NCC Bank | 9.35 | 9.35 |

| 25 | Citizens Bank | 9.09 | 9.09 |

| 26 | Century Commercial Bank | 8.42 | 8.42 |

| 27 | Civil Bank | 8 | 8 |

Earnings per Share of Commercial Banks in Nepal

| S.N | Commercial Bank | Earnings Per Share (EPS) |

| 1 | Rastriya Banijya Bank | 49.44 |

| 2 | Nabil Bank | 37.24 |

| 3 | Agricultural Development Bank | 32.88 |

| 4 | NIC Asia Bank | 32.13 |

| 5 | Global IME Bank | 16.27 |

| 6 | Nepal Investment Bank | 18.07 |

| 7 | Nepal Bank | 22.66 |

| 8 | Himalayan Bank | 27.13 |

| 9 | Everest Bank | 31.15 |

| 10 | Prime Commercial Bank | 16.39 |

| 11 | NMB Bank | 16.73 |

| 12 | Siddhartha Bank | 21.38 |

| 13 | Standard Chartered Bank | 24.76 |

| 14 | Sanima Bank | 19.35 |

| 15 | Nepal SBI Bank | 17.09 |

| 16 | Mega Bank | 14.92 |

| 17 | Bank of Kathmandu | 17.26 |

| 18 | Laxmi Bank | 15.13 |

| 19 | Sunrise Bank | 15.53 |

| 20 | Prabhu Bank | 13.93 |

| 21 | Machhapuchchhre Bank | 14.78 |

| 22 | Nepal Bangladesh Bank | 15.01 |

| 23 | Kumari Bank | 12.77 |

| 24 | NCC Bank | 12.09 |

| 25 | Citizens Bank | 12.92 |

| 26 | Century Commercial Bank | 10.77 |

| 27 | Civil Bank | 5.71 |

Conclusion

From the above calculation results, we can conclude that Rastriya Banijya Bank has the highest EPS at Rs 49.44, and Civil Bank has the lowest EPS of 5.71.

Is a high EPS good?

Yes, the higher the figure the better because EPS shows you how much of a company’s profit after tax that each shareholder owns.

Is a negative EPS bad?

Yes, When EPS is negative, it indicates that the company is losing money.

How to improve EPS?

The EPS can be increased if they earn more or if they expand their margin by lowering costs. They can also utilize share buybacks; which means that they lower the number of shares that can be bought without making any alterations to the profits.