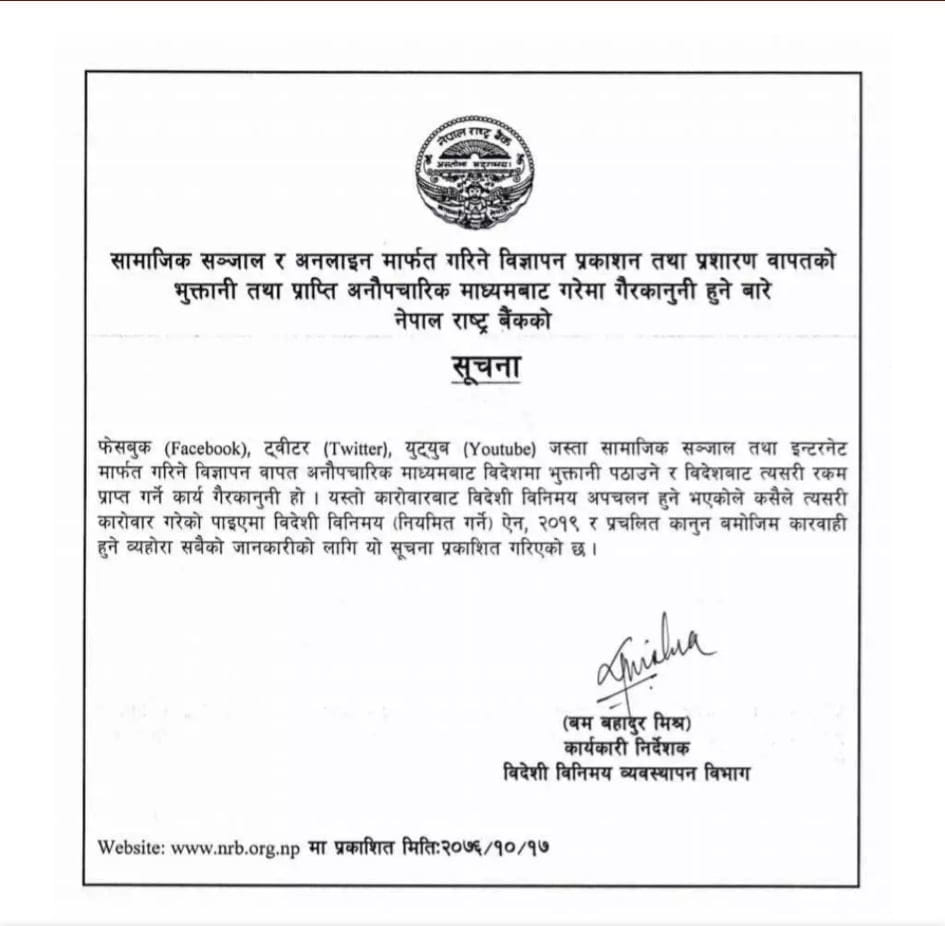

Nepal Rastra Bank warns to punish the marketers if they run ads on social media. NRB published a notice on Friday and informed about this.

Nepal Rastra Bank, Central Bank of Nepal says payment via an informal medium is illegal. This types of transactions lead to misuse of foreign currency.

How can payments on Social Media be made from Nepal?

If you were using the foreign currency from your friend who is living abroad for payments in social media, your work is illegal now.

This was the way what people from Nepal used to do for making payments in foreign countries and social media platforms.

If you want to make payments to social media platforms or any platform on the internet, you must go with the banking channel now.

But this channel is very hectic in Nepal.

You need to have a bank account for dollar transaction. For this, you must show the source of income that you get in dollars from a foreign land. After showing details, you will be eligible for creating dollar account. But showing income on dollars is not possible for every people. For this, you must work for any foreign company so that you can get income in dollars.

Is it possible to earn in dollars or in foreign currency from Nepal? If you earn foreign currency, then you can apply for a dollar account.

What will be the consequences of this notice?

To be positive, we can hope the government will make a clear policy for international payment gateway from Nepal. This will makes the payment option easier.

But until the proper policy on international payment gateway is made, it can have a negative effect.

How this notice impacts negatively?

Nepali “organic” startups can not advertise themselves in social media and in the internet. Advertising on newspaper, television and radio costs really high.

Also think, can these startups can advertise themselves there? If they can do it though, can they get there a specific audience?

Or are we going to the traditional marketing approach? Is the government backfiring digital marketing?

Also, Nepali local startups can not compete with an international brand of the same type.

Let’s take an example of Tootle and Pathao.

Tootle is a Nepali startup whereas Pathao is a company from Bangladesh.

As per this notice, Tootle can not advertise in social media platforms. One can say they can use dollar card for promotion in Nepal which will be legal. But how can tootle earn in the dollar and have a dollar account?

On the other hand, being a company from Bangladesh, Pathao can advertise digitally in Nepal from Bangladesh itself.

Now think how can Tootle compete with Pathao in the same market with the same audience? One can advertise its product while one being “Nepali Startup” can no advertise itself?

Is it possible to advertise on TV, Newspaper and Radio for a small startup company? How can they afford extra marketing cost?

Let’s take another example.

A honey farmer from Nepal can’t advertise its product in Social Media. But the multinational company “Dabur Honey” can. Now think, how can Nepali farmers grow? Aren’t we paying for the product imported rather than consuming our own organic product? Will this help to grow National Economy?

What can be the solution?

Banned of paid advertisements in social media using an illegal method is the solution. And it must be. But what is another way from where we can advertise our local product? Government, Nepal Rastra Bank once needs to think on this. If the government gives the proper solution for this payment option, it will be the most important decision made by the government for the digital growth of Nepal.

Government / NRB can communicate with Facebook and other social media platforms and can make proper provision for this.

What is the provision of tax and Facebook Ads in India?

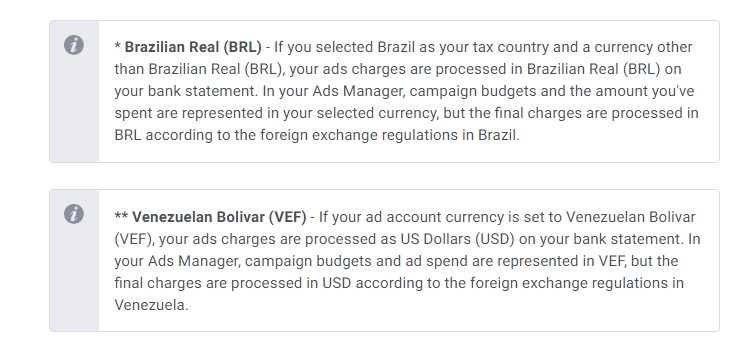

In India, the bill is paid for in Indian rupees and it is subjected to goods and service tax (GST) of 18%.

For this, advertisers in India needs to add their GST Registration Number to Facebook Ads Account.

Provision of tax and Facebook Ads in Brazil, Venezuela

So, if the government collaborates with Facebook and other social media and internet platforms, it can simply make a provision to add VAT Register Number to the ad account.

All needed is willpower from the Rastra bank / Government.

What do you think, what will be the solution to this problem in immediate as well as a long run? Write your thoughts on the comment box.